Tax rates in Iran

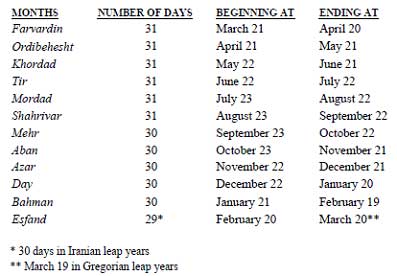

Iranian Calendar Year

The Iranian fiscal year starts March 21. The first 6 months of the solar year has 31 days each and the following 5 months has 30 days each. The last month however has 29 days, but the month has 30 days in leap years; that is, every four year. Names of the Iranian months and their correspondence to the months of the Gregorian calendar are as follows.

Corporate Income Tax

Rate Subject

25% The total income of companies as well as the income gained through different sources by legal persons living abroad or inside Iran

25% The Iranian noncommercial legal persons which have engaged in profit-making operations, while they are initially not established to do so

25% The non-Iranian legal persons and entities living abroad

Exceptions

Rate Subject

2% The foreign insurance companies which reinsure Iranian insurance companies

5% The tax imposed on foreign airlines and shipping companies involved in carrying passengers and freight from Iran

Exempt income

| Exemption | Rate of exemption | Duration |

|---|---|---|

| The income made by manufacturing and mining units whose operation licenses have been issued after April 27, 1992 and are located outside a radius of 120 km either from the city of Tehran, or 50 km from the city of Isfahan or 30 km from the cities having a population of 300,000 and more | 80% | 4 years |

| The production units located deprived areas | 100% | 10 years |

| The income made through exports of industrial finished products | 100% | perpetual |

| The income made through exports of all products already listed as those which are legal to be imported | 50% | perpetual |

| The income made through educational activities in universities, schools and vocational institutions | 100% | perpetual |

| The income generated through publishing, journalistic, cultural and art activities | 100% | perpetual |

| The income made by the cooperatives and guilds which produce handmade rugs and handicrafts | 100% | perpetual |

| All business activities in the Iranian trade zones are exempt from income and property tax | 100% | 20 years |

| The exports of non-oil commodities and service, with an exception of the raw material and goods which have low value-added | 100% | Until 2016 |

| The travelling and tourism institutions licensed by Ministry of Culture and Islamic Guidance | 50% | perpetual |

| The interest offered by banks and other credit institutions to fixed deposits, savings or current accounts | 100% | perpetual |

| The interest paid for government and treasury bonds | 100% | perpetual |

| The interest offered by foreign banks which receive loans have fixed deposits in Iranian banks | 100% | perpetual |

| The interest offered on land reform bonds | 100% | perpetual |

| The money paid by the National Development Fund | 100% | perpetual |

| The money paid by public funds for religious, educational and scientific activities | 100% | perpetual |

| The donations in cash or in kind as well as the membership fees received by associations, parties and private organizations | 100% | perpetual |

| The income generated by the agriculture and horticulture sector | 100% | perpetual |

| The income earned through swapping goods through Iran | 100% | perpetual |

| The donations in cash or in kind raised by the Red Crescent Society of Iran | 100% | perpetual |

| The donations in cash or in kind raised by pension saving funds, the Organization of Health Services Insurance and the Social Security Organization as well as the insurance premiums and pension contributions | 100% | perpetual |

| The donations in cash or in kind received by Islamic schools | 100% | perpetual |

| The donations in cash or in kind received by foundations of the Islamic Republic of Iran | 100% | perpetual |

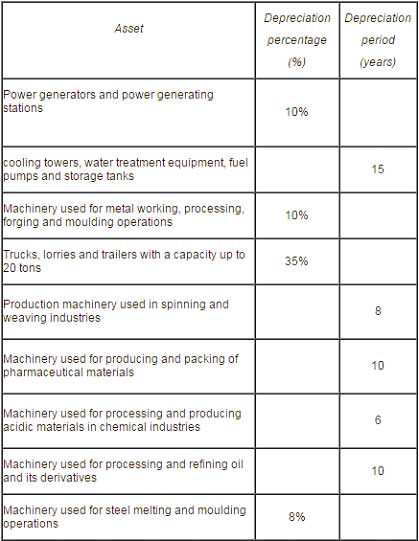

Depreciation Rates

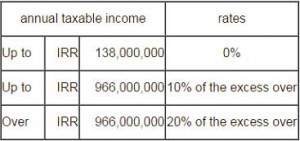

INDIVIDUAL BUSINESS & PROFESSIONAL INCOME TAX

EMPLOYMENT INCOME TAX

The salaries of the foreign diplomats and embassy staff, which are subject to reciprocal treatment, and of non-Iranian members of UN delegations and specialized international agencies100%

| Exemption | Rate |

|---|---|

| The salaries of foreign experts sent to Iran on aid programs | 100% |

| The salaries of local employees of Iranian embassies and consulates which are subject to reciprocal treatment | 100% |

| The salaries of those working in villages and deprived regions | 50% |

| The money paid as pensions, retirement allowances and termination of employment payments | 100% |

| The service-related travel expenditure and allowances | 100% |

| The housing, on-site accommodation, food and transport allowances and other non-cash benefits provided for manual labor | 100% |

| The money paid by insurance companies in compensation for medical costs and financial damages caused by accidents | 100% |

| The bonuses or gifts paid for New Year’s eve if they are not more than one-twelfth of the annual base minimum salary | 100% |

| The housing provided for civil servants | 50% |

| The medical expenditures of employees payable by employers | 100% |

| The salaries of the employees of the Armed Force and Intelligence Ministry as well as the salaries of war veterans and former prisoners-of-war (POWs) | 100% |

| The bonuses or gifts paid in kind to employees, which do not exceed two-twelfth of the annual base minimum salary | 100% |

* Base minimum salary refers to a minimum salary under the Labor Code. The amount is reviewed annually by the Ministry of Economic Affairs and Finance. The base minimum salary is 7,120,000 rials per month in the current fiscal year.

VAT

Taxable Entities

All entities involved in supply of goods and services and in trade activities are subject to the provisions of the VAT Law.

Taxable Transactions

In Iran, all transactions involved in the supply of goods and services or in the import and export activities are subject to the provisions of the VAT Law.

Taxable Amount

Tax is calculated based on prices of goods and services announced in invoices. However, if no invoice is available, no invoice is presented, or invoices prove to be fake – that is the prices are not real, tax auditors can calculated the tax based on prevailing prices of goods and services at the time of transaction. The following are excluded from the basis for calculating the tax:

⦁ Given discounts

⦁ VAT already paid by a supplier of the goods or services

⦁ Other indirect taxes payable in respect of the commodity or service at the supply time

The tax levied on imported goods is calculated based on the customs value of goods, which include the purchase price, freight charges and insurance, as well as the import duties, which include customs duties and commercial profits tax.

VAT Exemptions

The supply and imports of the following goods are exempt from VAT:

⦁ Unprocessed agricultural products

⦁ Live poultry and livestock, aquatic products, honey bees and silkworms

⦁ Poultry feedstock as well as all types of fertilizers, pesticides, seeds and saplings

⦁ Flour, bread, meat, sugar, rice, cereals and soya, milk, cheese, vegetable oil, and baby food

⦁ Books, note books and all types of printing papers and writing pads

⦁ Gifts and donations given to ministries, state organizations, public entities on the condition that they are verified by the Council of Ministers and recipients

⦁ Goods imported by travelers in briefcases

⦁ Medicines, medical products, medical services (human, veterinary and plants), as well as rehabilitation and chiropractic services

⦁ Employment services taxed under the DTA

⦁ Services offered by banks, credit institutions and cooperatives as well as interest-free loans provided by cooperative funds

⦁ Public transportation services, including road, railway, air and sea transportation services

⦁ Handwoven rugs

⦁ Research and educational services which are subject to a joint approval by the Ministry of Science and Technology; Ministry of Economic Affairs and Finance; Ministry of Health; Ministry of Education; and the Ministry of Cooperatives, Labour, Social Welfare;

⦁ Foodstuff for birds and pets

⦁ Radars and aeronautical navigation equipment for airports, as listed by the Ministry of Roads and Urban Development and the Ministry of Economic Affairs and Finance

⦁ Equipment exclusively used for defense and security purposes, as listed by the Ministry of Defense and the Ministry of Economic Affairs and Finance.

⦁ Business activities in the free trade zones and industrial zones

Rate

VAT rate in Iran is 9% for 1394 (March 21, 2015 – March 19, 2016).

Non-Resident Entities

Non-resident entities do not need to register for VAT in Iran. The companies or business people who import goods and services into the country should pay VAT, and not the non-resident exporters. VAT on imported goods is collected at the time of clearance by the Customs Administration.

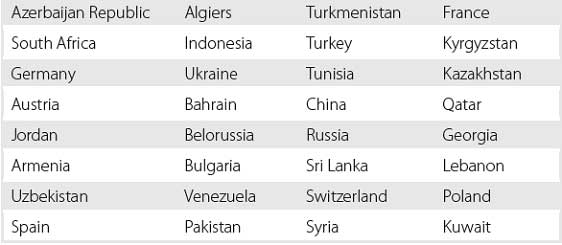

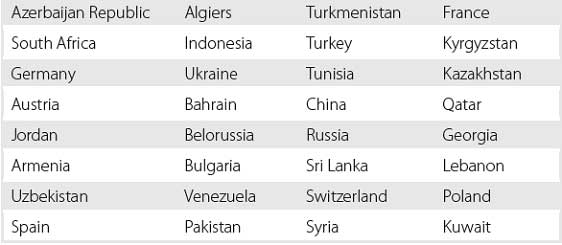

Avoiding Double Taxation

The Iranian government has agreed with some countries to avoid double taxation, in a move to boost bilateral trade ties. The governments of the countries listed below have signed agreements with the Iranian government to avoid double taxation.